The benefits package NPs receive when working locum tenens with Weatherby

December 22, 2025

Nurse practitioners (NPs) are increasingly turning to locum tenens as a way to take control of their careers, whether that means earning more, exploring new clinical settings, or simply gaining flexibility that’s hard to find in traditional roles.

But there’s a common misconception that locum tenens means sacrificing stability, especially when it comes to benefits.

That’s not the case for NPs who work with Weatherby Healthcare: You’ll receive a comprehensive suite of benefits. Here’s an overview of Weatherby’s benefits for locum tenens NPs.

You’re considered a W-2 employee

One major advantage of working with Weatherby is your employment status as a W-2 employee, which means you’re not responsible for handling self-employment taxes. You also gain access to benefits typically reserved for full-time staff roles.

“I am not a saver, so W-2 agencies are very helpful,” says Renée Watson, an adult care nurse practitioner. “They take the taxes out without me having to stress, ‘I’m going to owe the government money!’”

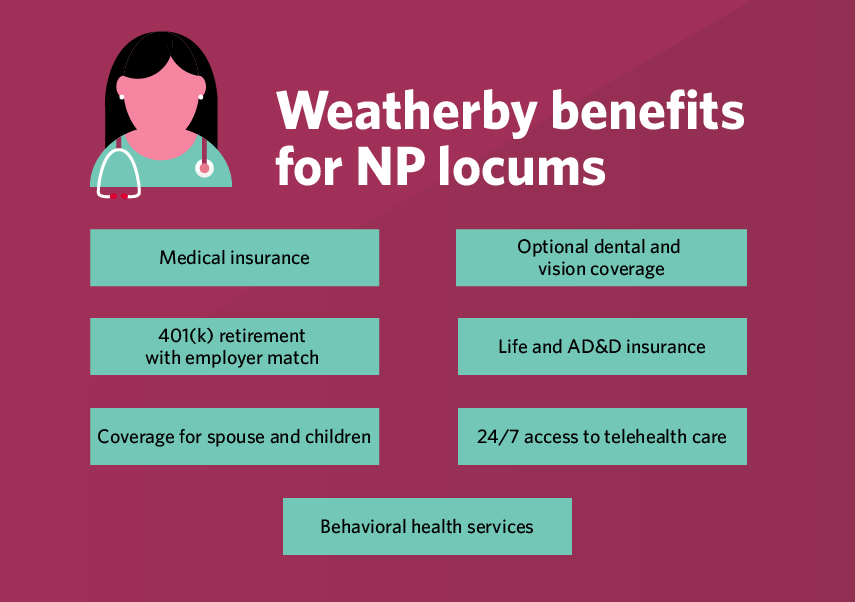

Beyond the convenience of tax withholding, the W-2 status gives you access to additional traditional benefits like medical and dental insurance, 401(k) retirement savings, and optional benefits like pet insurance, all without having to source them on your own.

Get the deets: Why NPs love working locum tenens

Coverage for your family and during breaks, too

Coverage can also extend to your spouse or domestic partner and dependent children, and if you take a short break between assignments (31 days or fewer), your coverage continues uninterrupted with no need to re-enroll. However, keep in mind that the cost of premiums accrued during the gap will be paid out of your next assignment’s paychecks.

If you have a longer gap between assignments or decide to discontinue working with Weatherby, you’ll still be eligible for COBRA continuation of coverage for your health benefits. You can elect COBRA coverage for up to 18 months; however, Weatherby will no longer contribute to your premiums once your employment ends.

Comprehensive medical coverage that fits your needs

Weatherby offers locum tenens NPs three health plans: ValueCare, ChoiceCare, and SelectCare. Each is designed to meet different levels of medical need and budget and offers varying deductibles and premium options. All three plans are PPOs, meaning you can see any in-network provider or specialist of your choice without a referral from a primary care provider. Healthcare benefits are managed by AmeriBen, a third-party administrator that is available 24/7.

Weatherby pays a portion of the cost of premiums through an employer contribution.

24/7 access to telehealth care

NPs who enroll in medical coverage also get access to CirrusMD, a telehealth platform that offers round-the-clock virtual access to board-certified physicians.

Whether you’re traveling or just need a quick consult for a non-emergency issue, CirrusMD is a cost-effective and convenient alternative to urgent care.

If you are enrolled in ChoiceCare or SelectCare, the service is completely free. ValueCare members pay a $50 copay.

Behavioral health support

In 2025, Weatherby transitioned to Headspace for both behavioral health and Employee Assistance Program (EAP) services.

Through the Headspace app, NPs and their dependents (ages 13 and older) can access:

24/7 text-based mental health coaching

Guided self-care and meditation tools

Six in-person or virtual therapy sessions per issue, per year

Financial and legal consultations

Emergency mental health assessments

This service is also available in Spanish to individuals 18 years and older.

Dental and vision: Optional but affordable

You don’t have to enroll in medical coverage to take advantage of Weatherby’s dental and vision benefits. These optional benefits can also be extended to your dependents.

The dental plan covers preventive care at 100%, and includes options for basic and major services, as well as child orthodontia. The vision plan, meanwhile, offers affordable copays on exams, lenses, and frames.

Long-term financial wellness: 401(k) with matching and more

Planning for retirement is easy with Weatherby’s 401(k) plan, administered by Fidelity Investments. You can contribute 1–75% of your eligible earnings, and Weatherby will match 50% of the first 8% you contribute.

You are eligible to make contributions from your start date, and vesting in the employer match begins after one year of service.

Additional benefits for NP locums

Weatherby’s benefits package doesn’t stop at healthcare and retirement. Other perks include:

$50,000 in company-paid life and AD&D insurance

Optional Nationwide pet insurance, including wellness plans

Benefits from PerkSpot, a national discount program for travel like airfare and ride shares, cell phone services, clothing, entertainment, and more

Dedicated support from Weatherby’s people services team, available to answer your questions via phone or email.

Earn more, work less: How locums pay works for NPs

A consultant who’s in your corner

Beyond the benefits themselves, Weatherby’s support team and recruiters help ensure you are set up for success from day one. For locum tenens NP Sasha Dunbar, this support has helped her focus on patient care and enjoy her time off.

“With locums, I’m able to go in and do my job, give my patients what they need, and then have time after that because I don’t have commitments to whatever company I’m working with for committees and projects,” she says.

My consultant is personable and open to communication, and someone who has my back in terms of ensuring I am satisfied with what is happening with my assignments.

Who’s eligible for coverage?

If you choose to enroll, you can extend coverage to your spouse, domestic partner, and/or dependent children up to age 26. Your premium rate will vary based on the number of individuals you include in your plan.

Build the career and lifestyle you want

The ability to work when and where you want, combined with full W-2 benefits, is not only what draws many NPs to Weatherby but also what keeps them coming back.

“I think I’ve had more vacation time since I started working as a locum than I ever had doing any other job,” says Dunbar. “Because the pay is good, you can do that and not have to make too many sacrifices.”

With locums, you can afford to take two months off if you want to and not have it be detrimental to your financial situation.

Whether you’re seeking schedule flexibility, professional development, financial growth, or all of the above, Weatherby’s locum tenens benefits are designed to support every stage of your NP career.

For more detailed information on Weatherby’s health benefits for locum tenens NPs, speak with your consultant or contact the Weatherby people services team directly at 800.811.1796.

Interested in learning more about working as locum tenens PA or NP? Give us a call today at 954.343.3050 or view today’s nurse practitioner job openings.